If you have been in the world of Sales Development for a while may have noticed that the amount of research required has skyrocketed over the past 5 years.

Personally, I feel like I “blinked” and the SDR role turned into private detective work. I might even buy a few trench coats to raffle off! (merch idea?)

Why you should research a lead before reaching out

Cold emailing is a primary method of sales outreach and prospects are getting bombarded with sales emails every day. It can be tough to stand out in the prospect’s inbox – queue prospect research!

By researching the person you are going to email you can tailor that email to them specifically. This shows the prospect that you have done your research and are thoughtfully reaching out. Couple this with strong messaging and you have strengthened your chances of getting a response.

There is one major caveat to this…

Good research does not replace relevant messaging that speaks to a challenge they are facing and the solution to that challenge.

In other words…

Research helps you cut through the noise, messaging converts that prospect into a meeting.

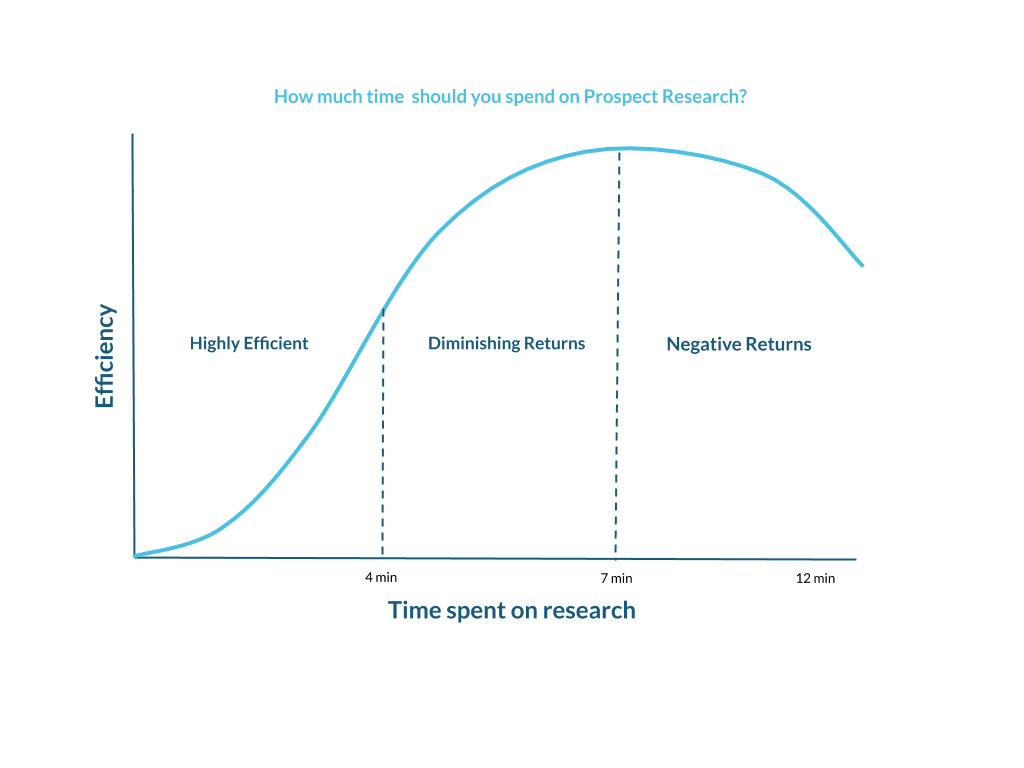

Researching your prospects is very important but can become a misuse of your time if you don’t have a plan. There is a curve of effectiveness that you need to be aware of.

As you can see above, there is a point of diminishing returns. The goal of this article is to give you a framework to follow that will prevent you from “wasted research time.” Let’s dive right in!

What the Heck is the Homophily Effect?

Homophily is a term used to describe the behavior of humans who have non-negative ties to each other. Meaning, people are more attracted to those that share qualities or backgrounds. By having a deeper understanding of their environment, the more they will be willing to open up to you and share with you the pain they are experiencing. That connection creates trust, where they feel you’re a “friend” to them and may be able to help with their challenges.

Trust is a major barrier in prospecting. If the prospect doesn’t trust you they will not reply to your emails or book a meeting over the phone. By understanding the world of your prospect you will be able to build trust quickly, which will lead to more booked appointments. Part of your research must be focused on learning the world of your prospect.

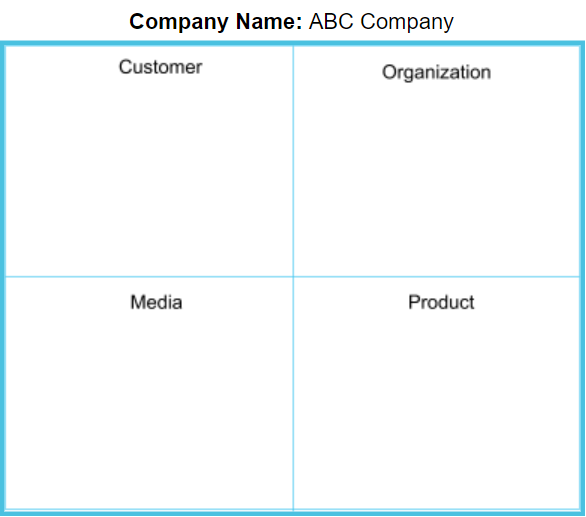

Framework for Account/Company Research (C.O.M.P.)

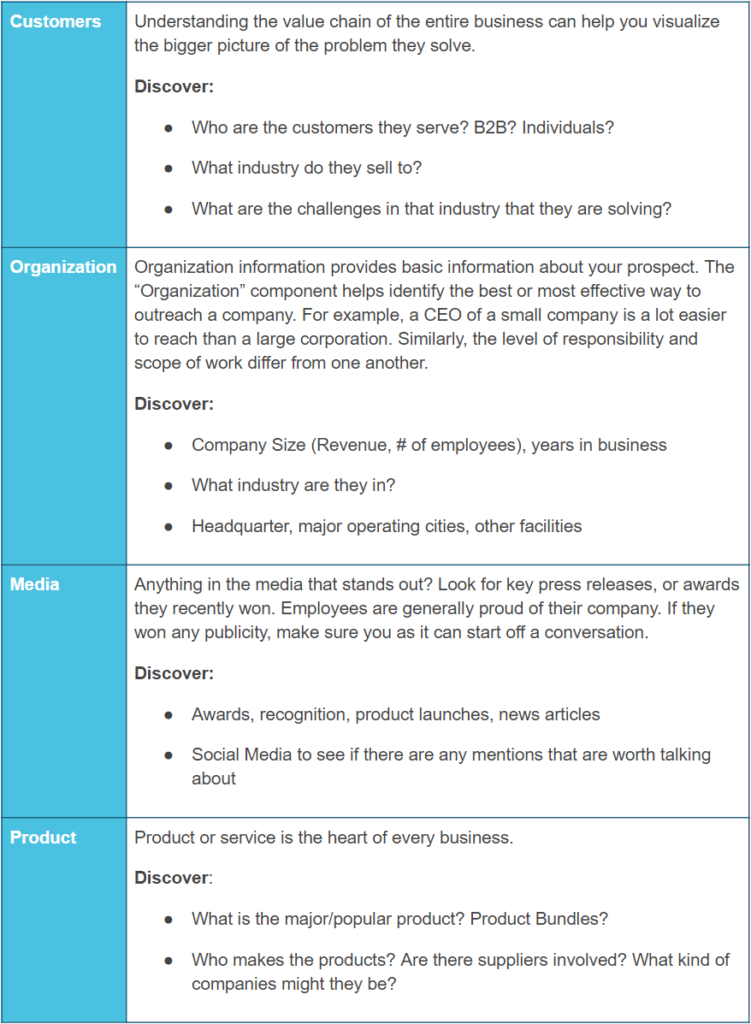

Here is a simple research framework that you can use to research Companies, C.O.M.P.

C.O.M.P. stands for Customer, Organization, Media, and Product. It’s the 4 major compositions of effective research that gives a holistic view of the company you’re about to speak with. It assesses the entire vertical stream of the business, up to suppliers, and down to customers. The following guide will give you a preliminary understanding of your prospecting account, and all the value chain of that prospect. Note: this can be done in any order but we recommend Product, Organization, Customers, and Media.

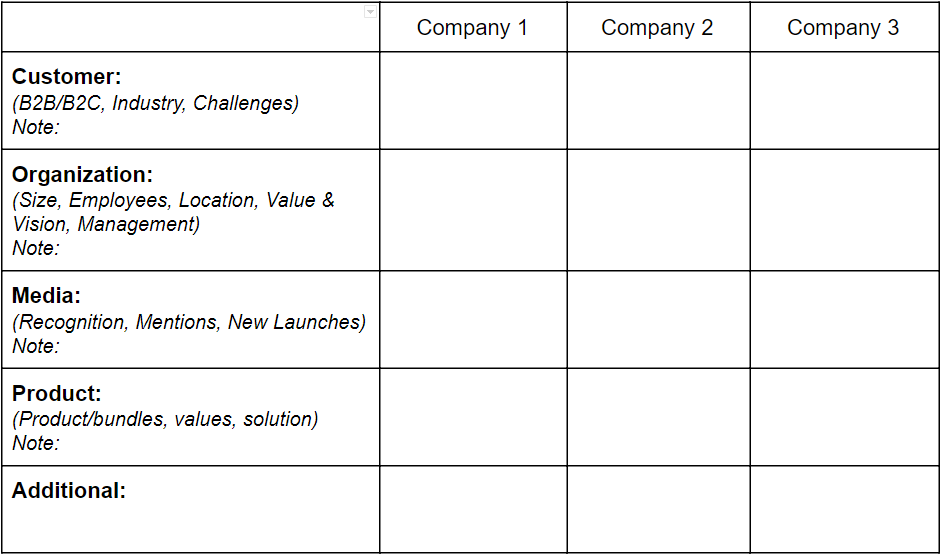

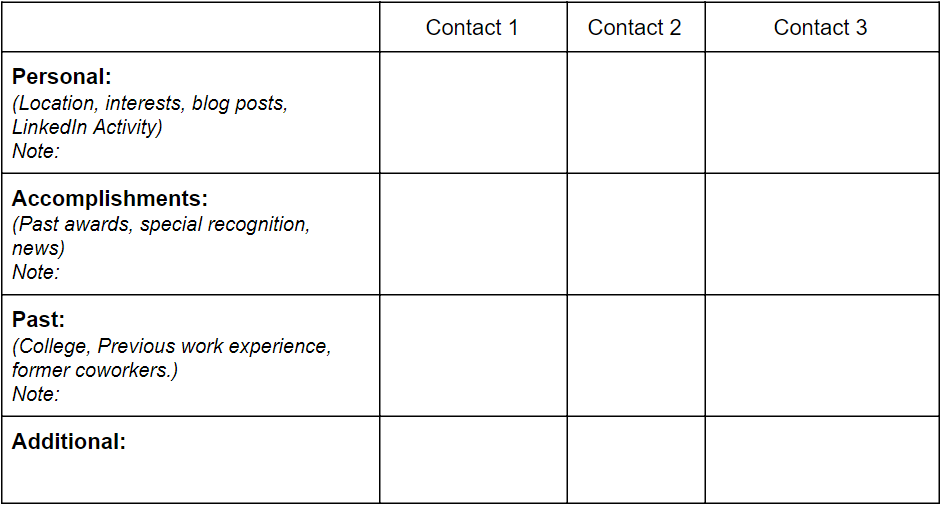

Company Research Template

Below are two different templates for collecting this information. If you would like interactive versions of all the templates you can download them from this link.

Template A:

The first option is a table where you can collect the information for multiple companies and then easily transfer it to the CRM.

Template B

Another template option is a Table with the 4 research categories. Completing one of these for each company and storing it in the CRM can make referencing research at a later date much easier.

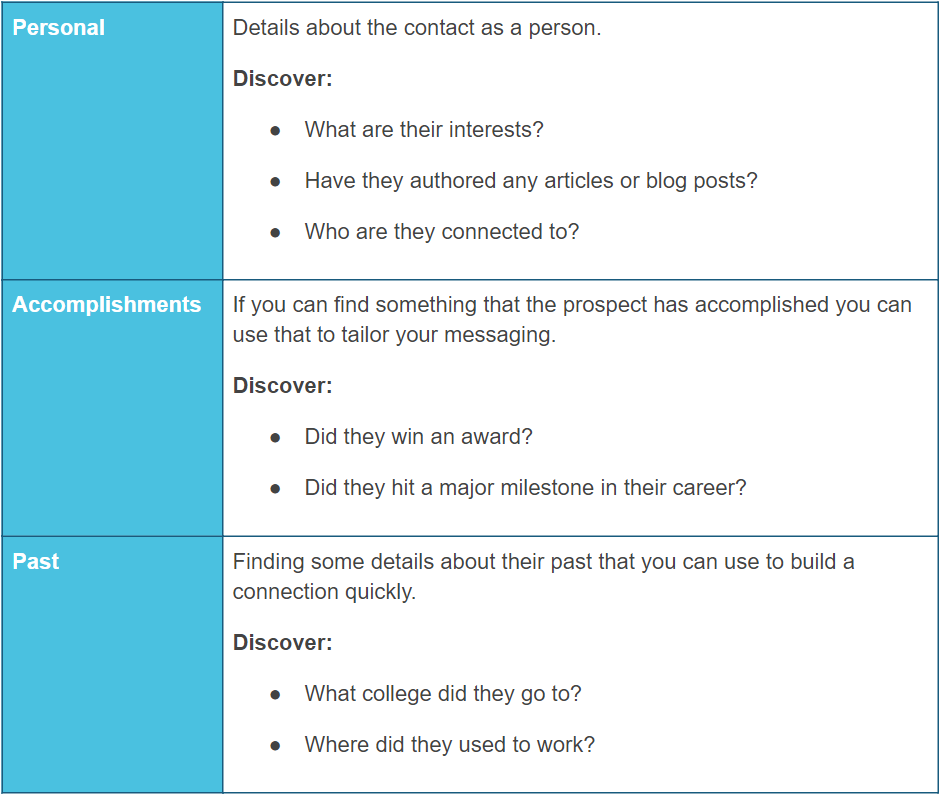

A framework for Lead and Contact Research (P.A.P)

If you couldn’t tell, I love Acronyms. Here is another simple framework for researching prospects, P.A.P.

P.A.P. stands for Personal, Accomplishments, Past. These are the three major components of contact research that if you become efficient at finding, will lead to fantastic results. Your goal is to quickly validate they fit your ideal customer profile and find some “attention grabbers” that you can use in your messaging to catch their attention. Below I have included a similar guide as the account research table from above.

Below is a template for collecting this information.

Where should you look while conducting sales research?

Before diving into the research strategy I believe it’s important for you to understand some of the research channels you have available to you. This is by no means an exhaustive list, but it will help give you some direction. Some of these channels will be relevant, some won’t be. Your goal is to identify the most effective research channels for you.

A “Company Page” on LinkedIn is basically a Facebook profile made for companies. It lists all the basic information like size, # of employees, locations, products/services and media. This is a great first stop, if you don’t have the information in the CRM. However be wary, as some companies do not update their profiles as often as they should, so you may see outdated information. In addition, you will only see the employees that have a LinkedIn account. This is typically most employees but some industries employ people who don’t use LinkedIn (EX: logistics companies). We also suggest that you look at the company’s daily/weekly posts to gauge how active they are on LinkedIn and check out the company website for updated information.

Company Website

This is where you’ll find up to date information about the company. It is also marketing heavy, since potential customers are the majority of viewers of a website. Look at products, features, and about pages to get a sense of what the company does and how your solution can help them specifically.

Media Release Page

One-stop portal for all the essential news related to the company. This is managed by the company so not all of them have it.

Mentions about the company or people who work there. You can get a more personal view into the company and some of their employees.

Financial Statement (Report 10-K)

Look for financial stability, CSR initiatives, overall strategy in the coming years. You will also be able to find some interesting things to talk about. Note: use CTRL+F when searching these reports, they are long!

Blogs

Blogs are normally an activity performed by the company’s marketing team to promote their business. It can be helpful for understanding how the company is positioning itself. Also, your contact may have written a blog post!

Review Websites

Capterra, g2 crowd, and Gartner are examples of review sites that talk about a product’s functionality, support and overall experience shared by their customers. Career sites like Glassdoor can also reveal information about their management, structure, and risk aversions. These can indicate whether they like to invest into employees or not.

Other Sites

Sites like Crunchbase and Angelist can provide profile-based information in addition to what you can find on LinkedIn. For example, information about funding rounds, investors, and recent news.

How does this all come together?

Just by reading this far you are probably overwhelmed by the amount of information you could potentially collect about one of your target accounts and contacts. This is why so many SDRs waste valuable time over-researching. There is so much information that you can collect and not enough time to collect it.

Here is the deal.

You must learn to quickly identify what type of information you will be able to collect on the company, and the contact. For example, if you go to a prospects LinkedIn page and it’s relatively empty, click off of it and try a different research channel. It sounds simple but you would be surprised how many SDRs waste precious time looking for information that is obviously not going to be found in the channel.

For researching contacts, I used to promote the 3×3 method: find three things in three minutes. I have since made a change, 2X4: find two items in four minutes. I made this change for three reasons.

- 3 minutes is a tight window and typically leads to very superficial research.

- That third piece of research was typically not needed.

- Finally, I like that it’s named after lumber.

Build your own workflow

The key to effective prospect research is to have your own workflow and improve it over time. You should have a repeatable process. Here is an example.

Company Research

- Open website, LinkedIn, and Google search in different tabs

- Skim website, collect information.

- Skim LinkedIn, collect information.

- Go through search results, including news and collect information.

- Save information to CRM for easy viewing.

Contact Research

- Open LinkedIn profile and Google search in separate tabs.

- Skim LinkedIn, collect information.

- Skim google search results, collect information.

- Use other channels if necessary.

- Save information in the CRM for easy viewing.

At the end of the day, you will land on a workflow that works well for you. Talk to your coworkers and try and understand their research process. Specifically learn what type of research is the most helpful when prospecting and prioritize that. Once you know what you are looking for, figure out the fastest way to get there.

Keep yourself on track

Research takes discipline. It is very easy to go down rabbit holes and spend a ton of time on researching a prospect. What separates top performing SDRs from the rest is their ability to keep their efficiency high. Stay focused, keep yourself on track, and you will find yourself on top of the leaderboard in no time!

If you would like interactive versions of any of the templates in this article, don’t forget to go here.

This is guest post – follow Kyle’s blog – vouris.com